- Basic Building Materials

- Structural Building Materials

- Functional Building Materials

- New Materials

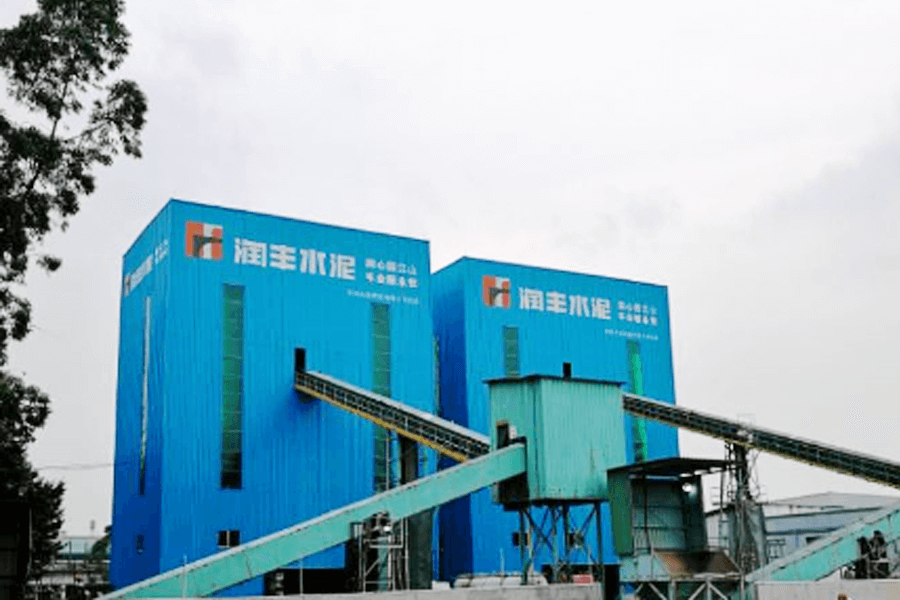

Guangdong Dongguan Cement commenced production

Acquired Guangxi Hongshuihe Cement

Acquired Guangxi Pingnan Cement

Guangxi Fangchenggang Cement was established

Guangxi Guigang Cement commenced production

Guangxi Nanning Cement commenced production

Acquired 34.14% equity interests in SDIC Hainan Cement (Changjiang Cement and Jinjiang Cement)

Guangdong Shantou Cement and Fengkai Cement commenced production

Guangxi Shangsi, Fuchuan and Tianyang Cement commenced production

Guangdong Yangchun Cement commenced production

Acquired the equity of Fujian Longyan Caoxi Cement and Sande Company (Caoxi Cement and Quanzhou Cement)

Acquired equity of Universal Cement corporation and acquired 50% equity of Guangzhou Yuede Company (Yuebao Cement and Zhujiang Cement)

Acquired 72% equity of Shanxi Fulong Cement

Acquired a 52.4% equity in Shanxi Yaohua Cement (increased the shareholding to 89.8%)

Guangxi Wuxuan and Luchuan Cement commenced production

Fujian Longyan Yanshan and Yongding Cement commenced production

Acquired equity in Fuzhou Xinshi Cement (Lianjiang Cement), Zhangping Zhenhong Cement (Zhangping Cement)

Acquired 93.79% equity of Yunnan Dali Sande Cement and Sande Building Materials (Midu Cement and Heqing Cement)

Acquired the equity of Shanxi Luliang Fangshan Cement

Acquired 40.6% equity in Mengxi Cement

Guangdong Luoding Cement commenced production

Fujian Longyan Yanshi Cement commenced production

Established joint venture company Anshun Cement in Guizhou

Acquired equity of Hainan Wuzhishan Dajiangnan Cement

Acquired 49% equity of Fujian Building Materials

Shanxi Changzhi Cement commenced production

Guizhou Jinsha Cement commenced production

Yunnan Midu Cement commenced production

Acquired and increased equity in Yunnan Cement to 50%

Guangdong Lianjiang Cement commenced production

Guangxi Hepu Cement commenced production

Guizhou Anshun Cement completed construction and commenced production

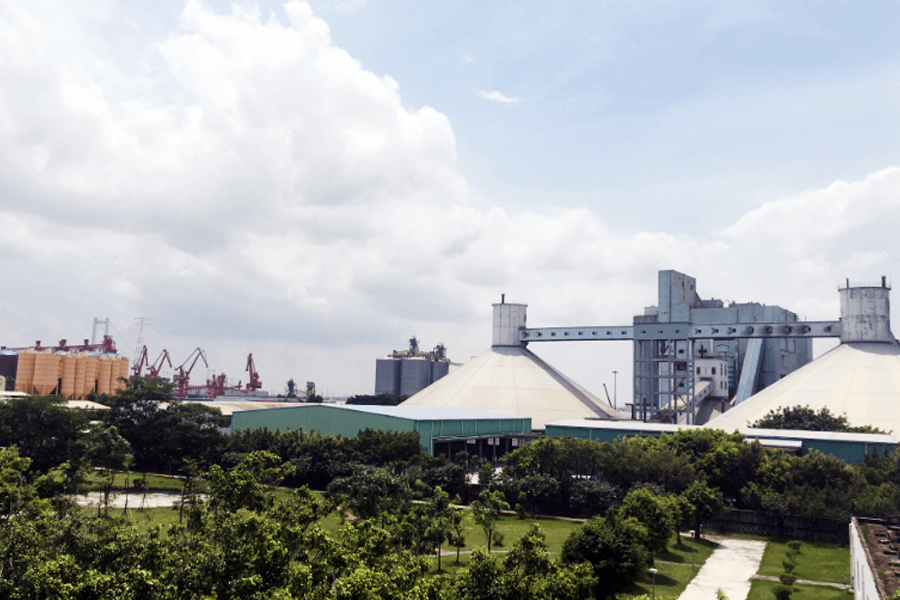

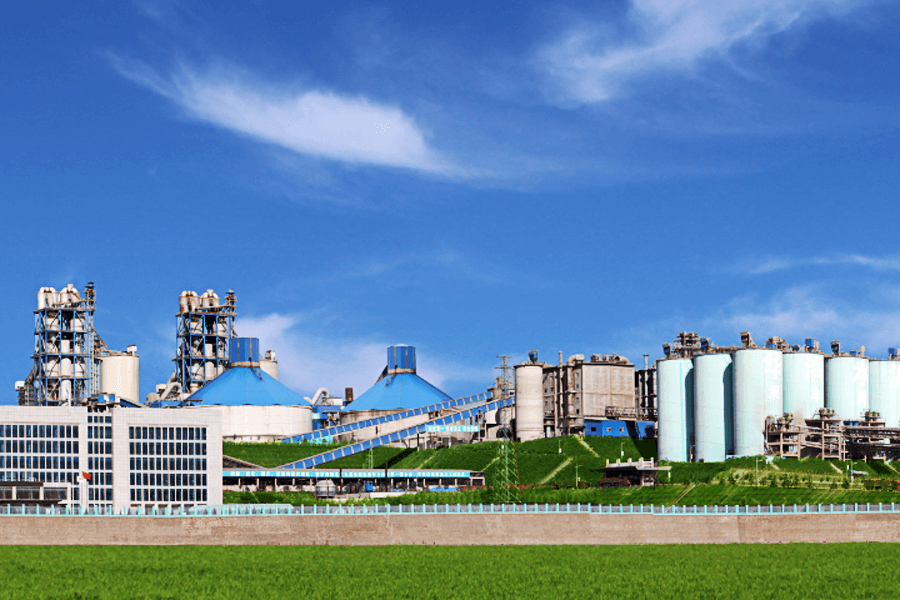

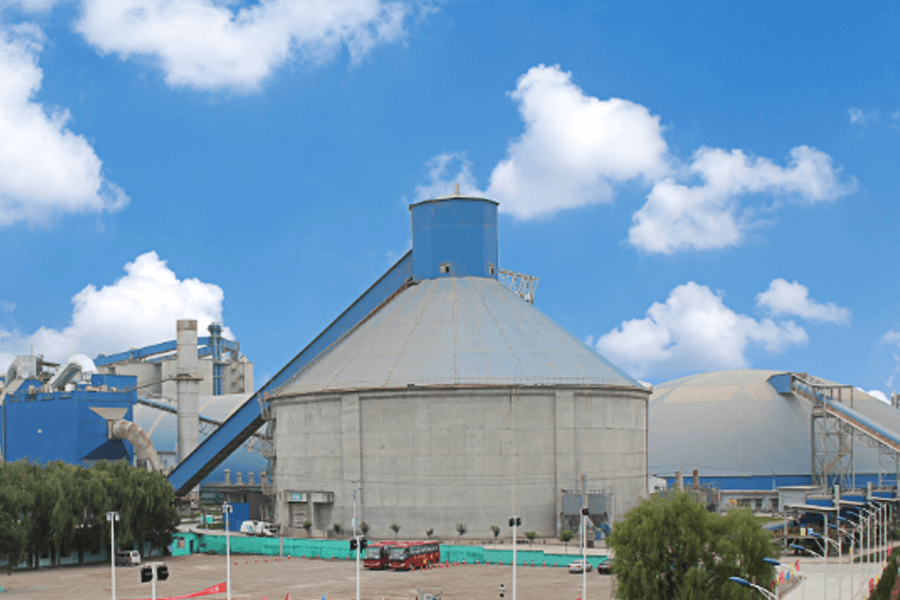

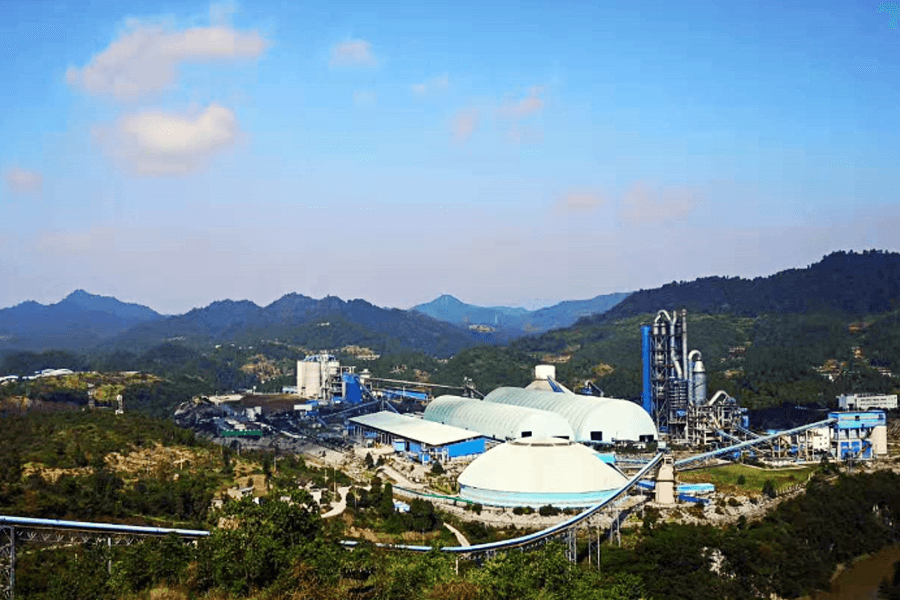

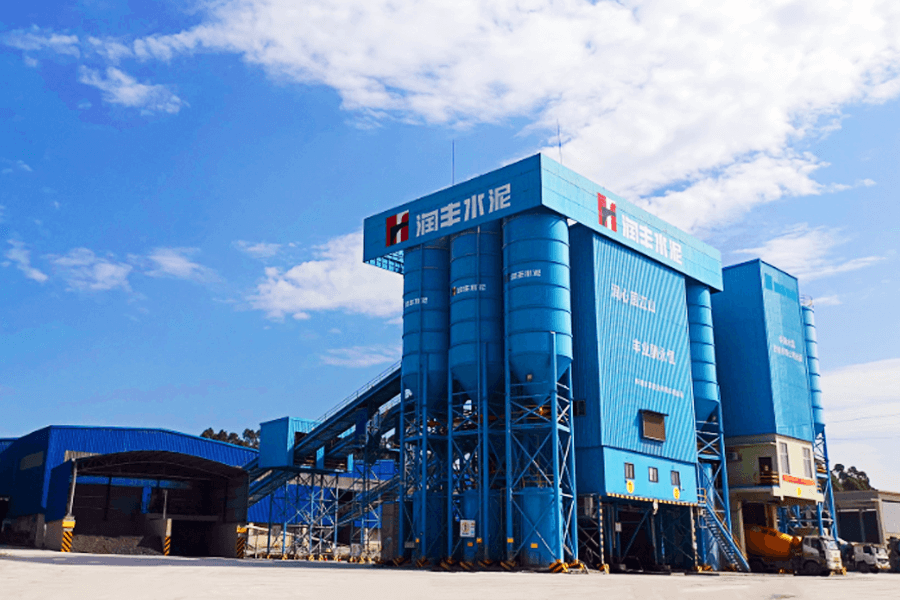

As at 30 June 2022, the Group had 95 cement grinding lines and 46 clinker production lines in operation, with annual production capacity of 83.3 million tons of cement and 61.1 million tons of clinker respectively. The location of the production facilities and their capacity are as follows:

Distribution of China Resources Cement's cement and clinker production lines

| Region | Cement production lines (No.) | Cement capacity (10,000 tons per year) | Clinker production lines (No.) | Clinker capacity (10,000 tons per year) |

| Guangdong | 24 | 2,250 | 10 | 1,440 |

| Guangxi | 37 | 3,320 | 18 | 2,650 |

| Fujian | 14 | 1,010 | 6 | 700 |

| Hainan | 5 | 440 | 3 | 330 |

| Yunnan | 7 | 510 | 4 | 390 |

| Guizhou | 4 | 400 | 2 | 300 |

| Shanxi | 2 | 200 | 1 | 150 |

| Hunan | 2 | 200 | 2 | 150 |

| Total | 95 | 8,330 | 46 | 6,110 |

In addition, through our equity interests in certain associates and joint ventures, the Group has a total of 79 cement grinding lines and 30 clinker production lines with a total annual production capacity of 66.4 million tons of cement and 37.0 million tons of clinker. These production capacities are located in Guangdong, Fujian, Yunnan and Inner Mongolia. The respective annual production capacities attributable to the Group according to our equity interests of these associates and joint ventures were 22.7 million tons of cement and 12.3 million tons of clinker.

Acquired Fujian Changtai Mining

Guangxi Fuchuan Aggregates and Hongshuihe Aggregates commenced production

Hainan Ledong Aggregates commenced production

Guangxi Wuxuan Aggregates commenced production

Guangdong Fengkai Aggregates commenced production

Guangdong Yangchun Aggregates commenced production

Guangxi Guigang Aggregates commenced production

Shanxi Changzhi Aggregates commenced production

Guangxi Nanning Aggregates and Tianyang Aggregates commenced production

Guangdong Dongguan Concrete commenced production

Guangxi Nanning Concrete commenced production

Acquired equity interests in Foshan Shunan Concrete

Acquired equity interests in Shenzhen Railway Construction Concrete

Guangdong Foshan Concrete commenced production

Guangxi Nanning Xixiangtang Concrete and Beihai Concrete commenced production

Guangdong Xiamen Concrete commenced production

Acquired Guangdong Heyuanpengyuan Concrete

Guangxi Qinzhou Concrete and Fangchenggang Concrete commenced production

Guangdong Fengkai Concrete and Gaoyao Concrete commenced production

Guangxi Guigang Concrete and Liuzhou Concrete commenced production

Guangdong Zhanjiang Concrete and Jiedong Concrete commenced production

Guangxi Baise Concrete, Laibin Concrete, Yulin Concrete and Hezhou Concrete commenced production

Acquired equity interests in Guangdong Huizhou Global Concrete, Guangdong Yangjiang Penggang Concrete and Zhejiang Ningbo Global Concrete

Guangdong Zhuhai Concrete commenced production

Hainan Dingan Concrete commenced production

Shanxi Lucheng Concrete commenced production

Hainan Chengmai Jinjiang Concrete commenced production

Guangdong Luoding Concrete commenced production

Guangxi Wuzhou Concrete and Jingxi Concrete commenced production

Hainan Ledong Concrete commenced production

Yunnan Dali Concrete commenced production

Guangdong Maoming Concrete and Lianjiang Concrete commenced production

Hainan Chengmai Laocheng Concrete commenced production

Guangdong Suixi Concrete commenced production

Guangxi Luchuan Concrete and Rongxian Concrete commenced production

Guangxi Nanning Liangqing Concrete commenced production

Acquired equity interests in Guangdong Yuequn Concrete

Guangxi Liuzhou Xijiang Concrete commenced production

Guangxi Baise Pinggui Concrete and Laibin Kunan Concrete commenced production

Guangxi Nanning Wuhe Concrete formally commenced production

Guangxi Tianyang Concrete commenced production

Distribution of China Resources Cement's concrete batching plants

| Region | Concrete batching plant (No.) | Concrete capacity (10,000 m3 per year) |

| Guangdong | 22 | 1,410 |

| Guangxi | 29 | 1,730 |

| Hainan | 5 | 270 |

| Yunnan | 1 | 60 |

| Shanxi | 1 | 60 |

| Zhejiang | 2 | 110 |

| Hong Kong | 3 | 150 |

| Total | 63 | 3,790 |

As at 30 June 2022, the Group owned 63 concrete batching plants with annual production capacity of 37.9 million m3

of concrete. Through our equity interests in certain associates and joint ventures, we owned a total of 20 concrete

batching plants with total annual production capacity of 9.8 million m3. Based on our equity interests in these

associates and joint ventures, the respective annual production capacity attributable to the Group is 4.6 million m3.

This is mainly used in the construction of houses, roads, bridges, water conservancy.

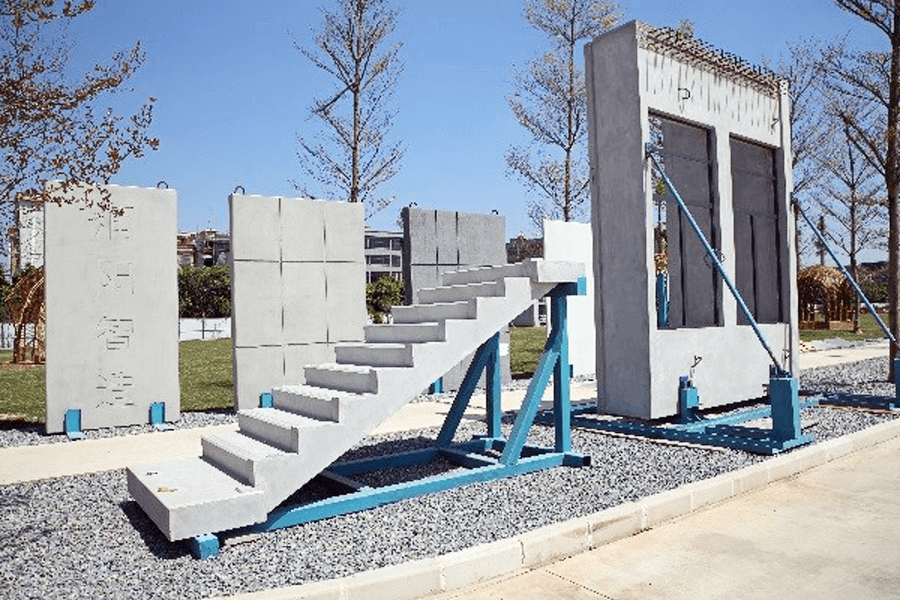

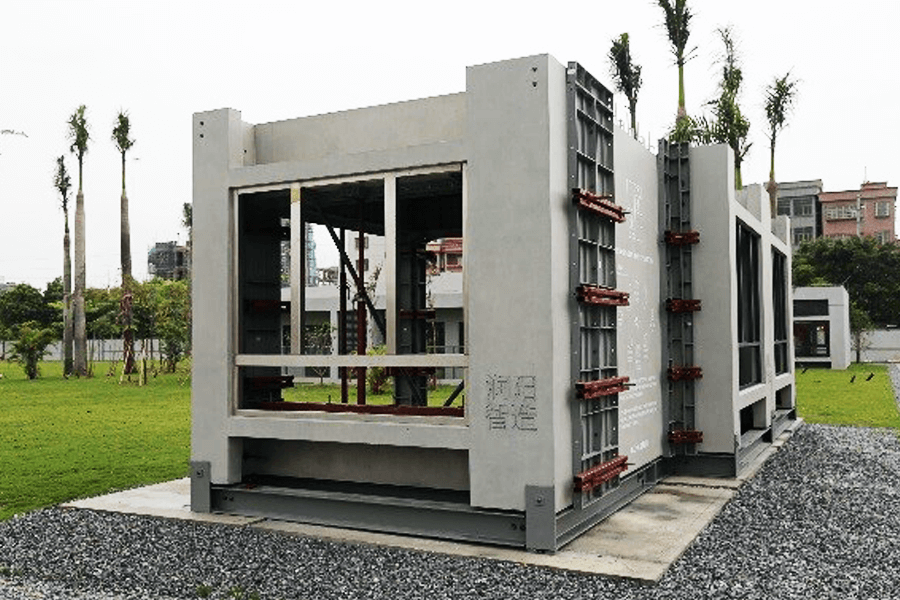

Prefabricated building refers to a building in which some or all of the components are prefabricated in the factory and then assembled on the construction site. Compared with traditional building construction, prefabricated construction can reduce construction waste, energy consumption, noise and dust pollution during construction, which could help improve quality and safety standards.

Given the opportunities from the vigorous development on the prefabricated construction in China, together with the development strategy of the industrial chain extension, China Resources Cement had further optimized resources distribution through its positioning in Southern China and actively promoted its prefabricated construction business.

2017

CR Cement has started to involve in the field of prefabrication.

2018

In May, Dongguan RunYang United Intelligent Manufacturing Co., Ltd., an associate jointly established by CR Cement and Shenzhen Capol International & Associates Co., Ltd., had commenced production and operation. The main products include prefabricated shear walls, prefabricated external slabs, and laminated floor slabs, which can fully cover prefabricated components for buildings, interiors and landscape. The associate is committed to providing customers with systematic solutions to prefabricated buildings which integrate product design, production, manufacturing, construction and installation.

The Company successfully won the bid for the industrial land in Nanning City and Guigang City of Guangxi, and Zhanjiang City of Guangdong respectively for the production of prefabricated construction components.

2020

In January, CR Cement acquired land for the production of prefabricated construction components in Jiangmen City of Guangdong and Laibin City of Guangxi. In April, the Company acquired land for the production of prefabricated construction components in Baise City of Guangxi.

Phase 1 production line of precast concrete components of the Guigang Runhe Project had commenced trail production in June.

2021

Ding'an Runfeng had commenced trial production in April. As of the year end of 2021, we had 5 projects in operation (including trial production) and 2 projects under construction. Following the completion of construction, the designed annual production capacity of precast concrete components is expected to reach 1.6 million m3.

Relevant information of the projects is outlined below:

| Number | Region | Project | Capacity | Status |

| 1 | Guangdong | Dongguan Runyang* | 40,000 m3 | In operation |

| 2 | Zhanjiang Runyang | 400,000 m3 | In operation | |

| 3 | Jiangmen Runfeng | 50,000 m3 | Under construction | |

| 4 | Guangxi | Nanning Wuhe | 400,000 m3 | In trial prodcution |

| 5 | Guigang Runhe | 200,000 m3 | In trial production | |

| 6 | Baise Runhe^ | 200,000 m3 | Under planning | |

| 7 | Hainan | Ding'an Runfeng | 300,000 m3 | In trial production |

*The Group holds 49% equity interests of the associate DongGuan RunYang United Intelligent Manufacturing Company Limited.

^According to project type, the dry-mixed mortar and tile adhesive production lines of the project are shown in the chapter of "Functional Building Materials".

Functional building materials refer to non-load-bearing materials with architectural functions such as waterproofing, fireproofing, heat preservation, heat insulation, lighting, sound insulation and decoration. In order to get closer to the end-user and promote the extension of the industrial chain, China Resources Cement has established a functional building materials business unit, responsible for the overall management of engineered stone, natural stone, white cement, tile adhesive and other businesses.

The functional building materials sectionision uses Shenzhen Runfeng New Material Technology Co., Ltd. as its investment, research and development and marketing platform and has two subsidiaries, Dongguan Universal Classical New Material Co., Ltd. and Laibin Global Classic New Building Material Co., Ltd.

Shenzhen Runfeng New Material Technology Co., Ltd. was established on September 18, 2018. It is a wholly-owned subsidiary of China Resources Cement with a registered capital of RMB 780 million. It acquired 20.0061% of Universal Marble (Dongguan) Co., Ltd. in April 2019 and, together with the 19.9939% shares acquired in January 2019, holds a total of 40% equity stakes of Universal Marble. It also completed the acquisition of Dongguan Universal Classical New Material Co., Ltd. in January 2021. There are two engineered stone production plants in Dongguan, Guangdong and Laibin, Guangxi, one tile adhesive production plant in Fengkai, Guangdong, and one white cement production plant in Zhaoqing, Guangdong. The total annual production capacity of engineered stone, tile adhesive and white cement production lines in operation and under construction is 5.1 million m2, 400,000 tons and 400,000 tons respectively.

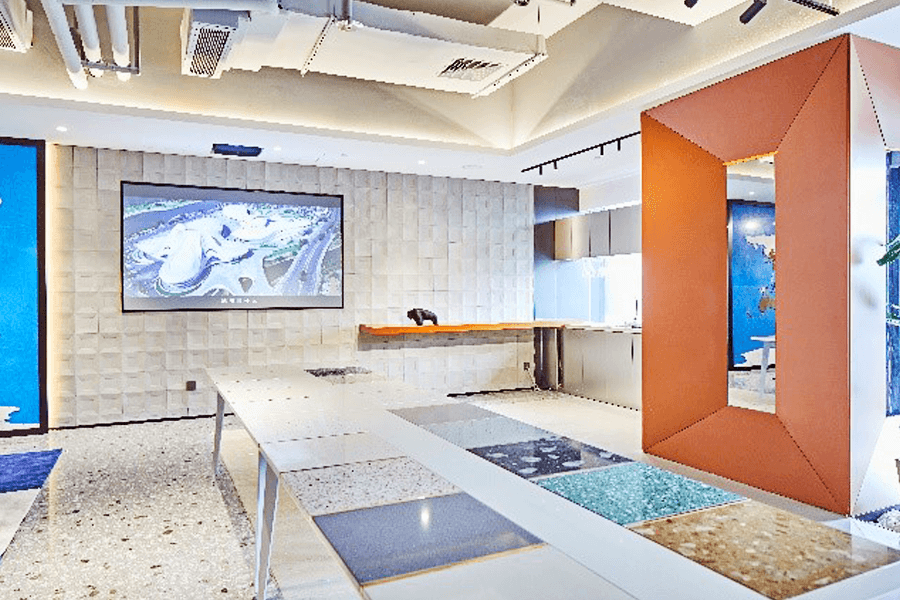

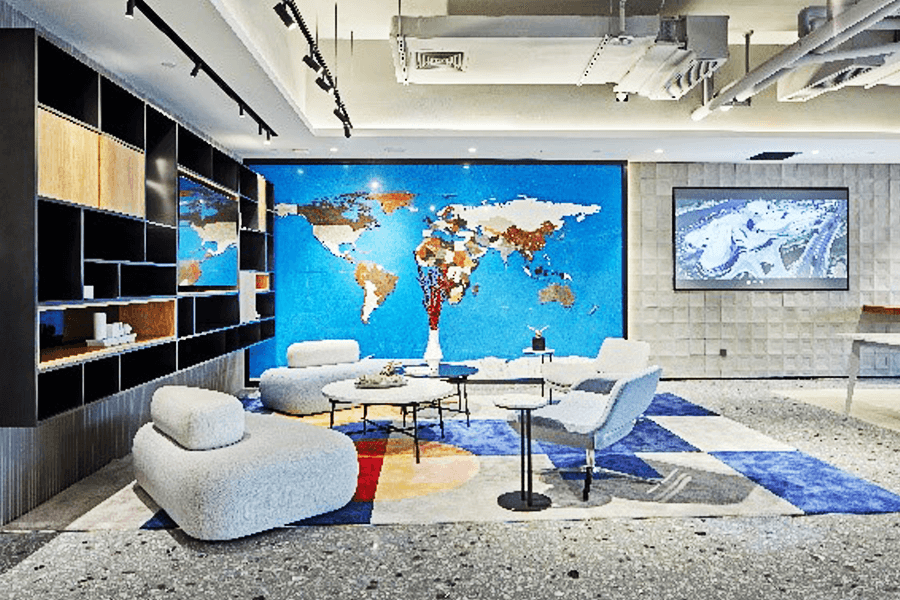

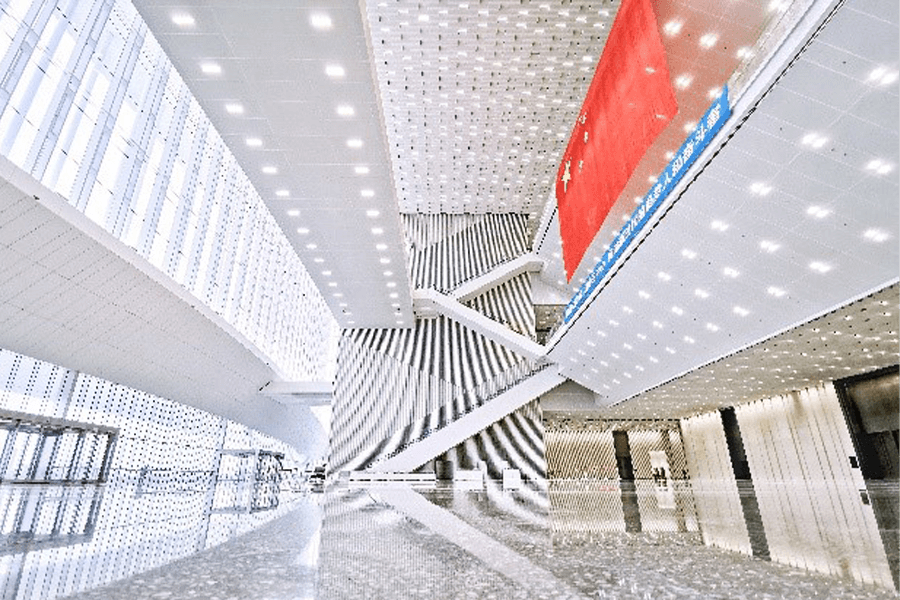

Shenzhen Runfeng New Material Technology Co., Ltd. RUN Stone-lab Exhibition (3)

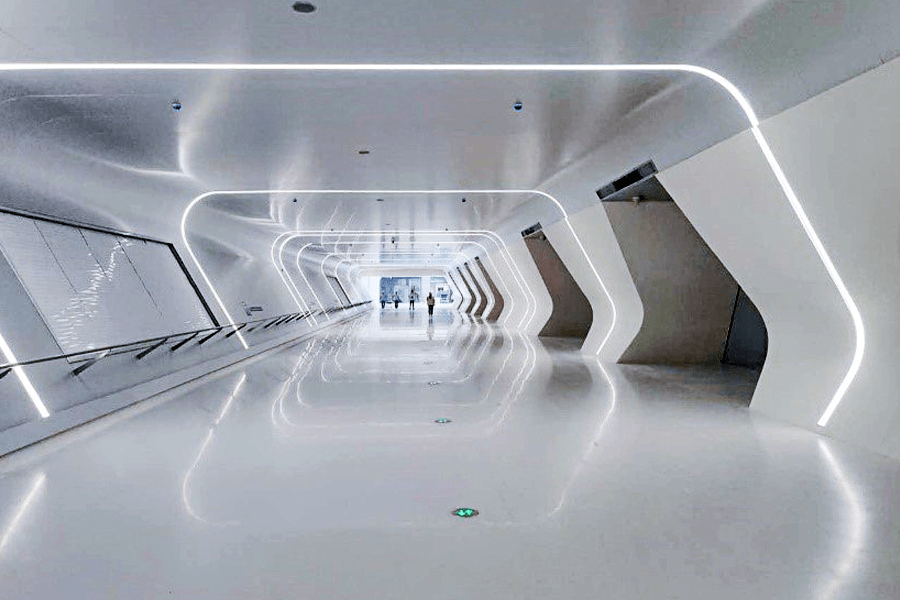

Utilizing the Italian Breton production line and process technology, engineered stone has six advantages: green and environmentally-friendly, top-of-the-line fire protection, large sizes, good weather resistance, rich colors and processes and easy installation and worry-free installation.

Engineered stone application reference: Headquarters of Shenzhuang Group

Runpin tile ahesive is independently developed by China Resources Cement. Its performance in construction operations and adhesion is greatly improved compared with the traditional cement mortar. It is suitable for the paving of materials such as ceramic tiles, engineered stone and natural stone, and can be customized in accordance to different applications and customers' needs. It is currently sold in Guangdong and Guangxi markets.

Runpin tile adhesive plant is located in the production plant of China Resources Cement (Fengkai) Limited. It had two fully-automated production lines with total planned annual production capacities of 400,000 tons. In reliance to the high-quality cement raw materials, aggregates and highly-automated production lines of the Fengkai production plant, the quality of products is thus guaranteed.

China Resources Cement will focus on the exploration and development of calcium-based materials, basalt materials and silicon-based materials.

Calcium-based materials are used in industries such as plastics, coatings, papermaking, rubber, food and medicine and building materials to produce highly active calcium oxide and provide flux lime products for iron and steel enterprises.

Calcium-based filling materials are split between heavy calcium and light calcium, which are mainly used in industries such as papermaking, plastics and rubber industries. Calcium oxide is mainly used in metallurgical fluxes.

The performance of basalt fiber is better than that of glass fiber, and there is greater room for replacement of steel bars and other fibers. Basalt stone material has the characteristics of high hardness, high strength, good wear resistance, high sliding coefficient and strong adhesion to asphalt. It is one of the best stone materials for high-grade highway surfaces, airport runways and railway ballasts. It is also a raw material for the production of cast stone, basalt paper, lime volcanic cement without clinker, decorative panels and man-made fibers. It is also an energy-saving raw material in the ceramic industry.

Basalt fiber is one of the four major high-performance fibers in China, and it has good chemical stability, chemical resistance, high temperature resistance, excellent mechanical strength, tensile strength and sound insulation and heat insulation properties. It is widely used in fields such as industrial pipes, adsorption, filter materials, construction and transportation.

(1) It is one of the better materials used in the construction of roads, railways, and airport runways.

(2) It is a high-quality raw material for the production of "cast stone".

(3) It is a good building decoration material, and is especially a better choice for floor stone.

(4) Porous basalt is a good aggregate, abrasive material, filter, dryer and catalyst for lightweight concrete in high-rise buildings.

(5) It acts as a "lubricant" in an advanced steel casting process.

From ordinary quartz sand to high-purity quartz materials to high-end single crystal silicon materials, silicon-based materials have a wide range of situations in which they are applicable.

High-purity quartz (>6N*) is a key material for the "stranglehold" key areas of semiconductors and integrated circuits. Silicon-based materials plays an important role in the quality and progress of China's infrastructure construction, the guarantee of raw materials and product quality of China's basic industries such as glass, quartz stone sheet, rubber, casting, tile glue, dry mortar, textiles and chemicals, as well as the development of China's energy and high-tech industries such as photovoltaics, optical fibers and semiconductors.